Canada recently issued its first green government bond. It was one of the last major developed countries to use this instrument to finance the greening of the economy. APG invested over 150 million euros. “To us, the issuance of green government bonds is a clear signal that countries have the ambition to address climate risks,” says Chris Lam, senior portfolio manager of developed markets government bonds at APG.

Green government bonds are issued by governments to finance “green” projects. They usually offer the same interest rate as their non-green counterparts and also provide an opportunity to contribute to a country’s climate efforts.

Preventing greenwashing

The Canadian bond is accompanied by a clearly defined list of green initiatives for which the proceeds may be used. In addition to projects that invest in renewable energy or provide protection from the effects of climate change, there is also an important role for conserving biodiversity in water and on land. This use of proceeds is important for preventing greenwashing.

Chris Lam: “APG has been strongly committed to the growth of green, social and sustainable (a combination of green and social, ed.) bonds from the beginning. But we do set requirements for their sustainable content. To make potential issuers aware of our expectations and to encourage healthy market growth, we are in constant dialogue with them. In 2019, we also published our Guidelines for Green, Social, and Sustainable Bonds.”

Big take-off

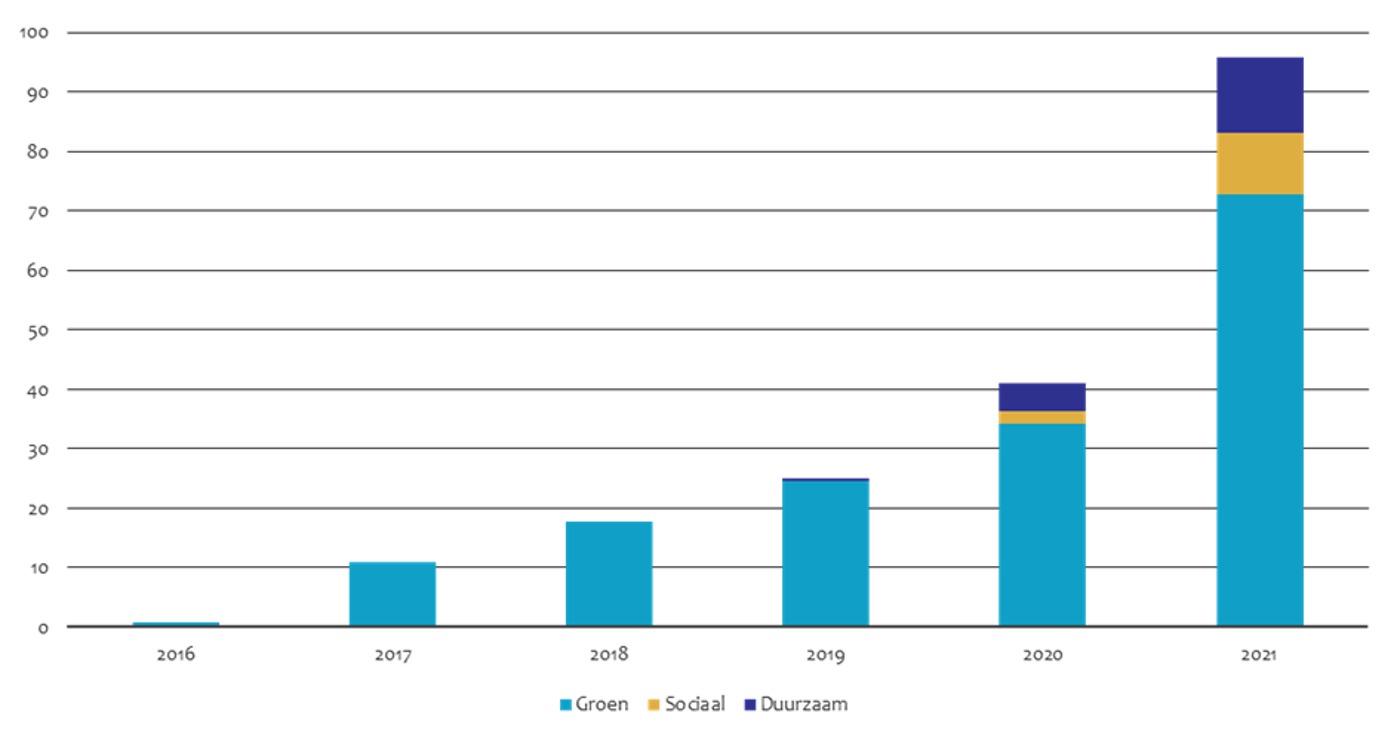

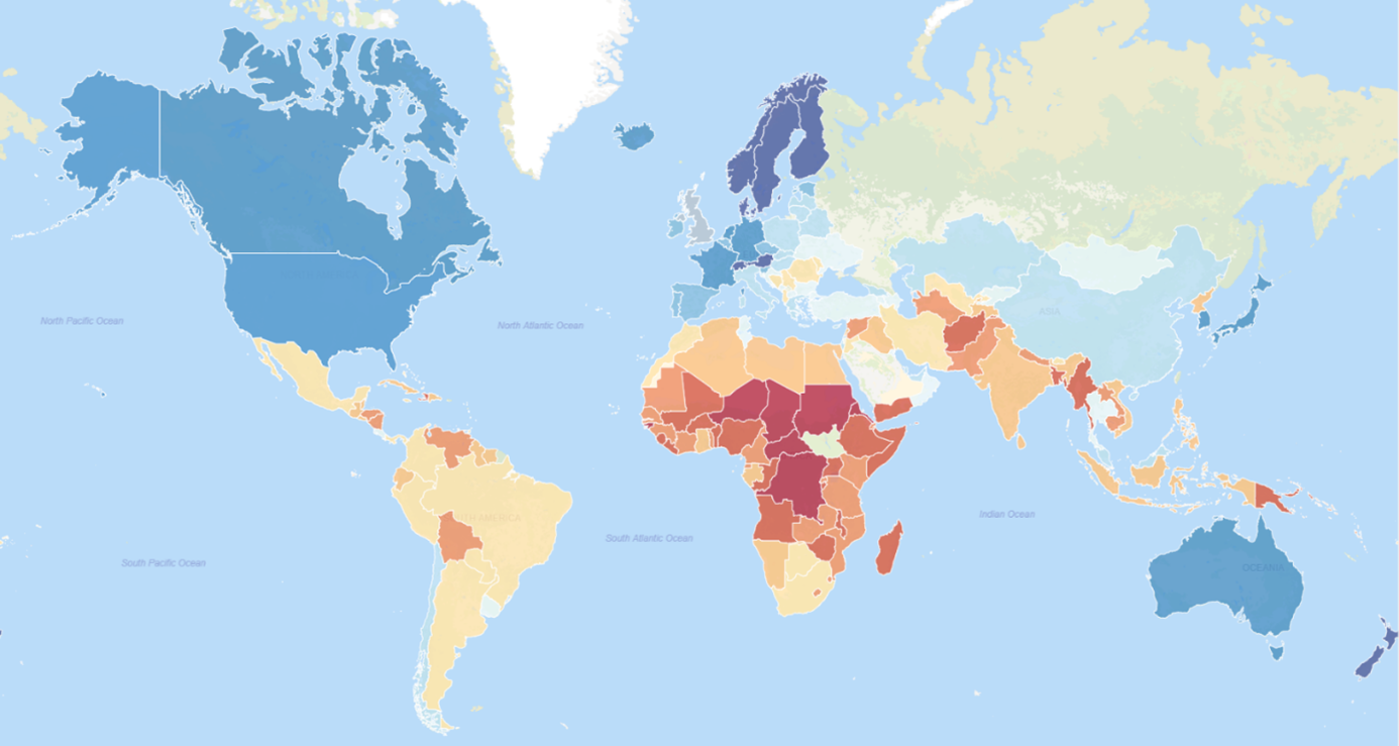

Investing in bonds with a sustainability focus has really taken off. More and more governments are now also issuing green government bonds. At the end of 2021, APG invested 7.3 billion euros in green government bonds on behalf of ABP, bpfBOUW, SPW and PPF APG. The vast majority of these, 7.25 billion euros, are bonds from developed countries, such as France, Belgium and the Netherlands. Just under EUR 50 million is invested in government bonds of emerging countries, namely Guatemala and Egypt. Add to this the investments in corporate bonds and, at EUR 17.6 billion, APG is one of the world’s biggest investors in bonds with a sustainability focus.

European Union

Lam does expect the trend in developed economies to level off after years of tremendous growth. “On the other hand, the European Union will become a major issuer of green bonds.”

Green bond investments are part of a broader approach to assessing climate risks in the fixed income portfolio. “Green bond issuance is a signal to us that countries have the ambition to mitigate climate change or take measures to guard against its effects. It gives us insight into the concrete steps governments are taking to combat climate change and to prepare the country for its physical impact.”

Green, social and sustainable government bond issuance (in billion dollars):